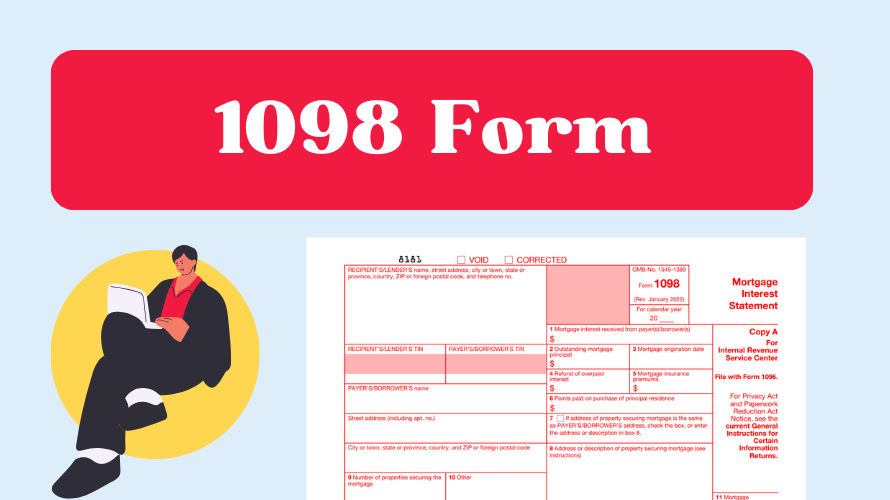

IRS Form 1098: Mortgage Interest

If you have a mortgage, there's an important document that you should be aware of come tax time: IRS Form 1098. This form plays a significant role when you're figuring out your taxes because it can provide you with a way to reduce your taxable income. Here, we're going to talk about what this form is and how you can use it effectively.

Filling Out IRS Form 1098

While homeowners don't need to fill out IRS Form 1098 for mortgage interest themselves, it is still important to understand what goes into it. A financial institution uses this form to report interest payments, and they will send you a copy for your records and tax preparation. However, there may come a time when you need to provide additional information to the IRS related to your mortgage interest. This is where understanding Form 1098 can come in handy. Let's look at some key points you should know:

- The name and social security number on the form should match the information on your tax return.

- It's not just the interest; certain points or insurance premiums may also be deductible.

- Always double-check the amounts listed to ensure they're accurate.

You'll want to keep this form with your other tax documents and provide it to your tax preparer or use the information if you're filing taxes yourself.

Why You Need the 1098 Mortgage Interest Form

The primary use for IRS Form 1098 is to report how much mortgage interest you've paid during the year. The bank or financial institution that holds your mortgage will usually send this form to you. Why does it matter? Well, mortgage interest is often tax-deductible, which means it can lower the amount of income tax you might owe.

Making Tax Time Easier

Those who wish to handle their taxes personally might search for a fillable 1098 mortgage interest form online. This can be useful if you're required to provide additional information regarding your home mortgage interest when filing your taxes. Fortunately, fillable forms are available from various online sources, including the IRS's official website.

Perhaps you prefer to keep a physical copy of your tax documents. In this situation, printing out a printable 1098 mortgage interest form makes it easier for you to have all your records in hand. Having all of the necessary documents printed and organized can streamline the process of working with a tax professional too.

Common Mistakes on Federal Form 1098 to Avoid

When dealing with the tax form 1098 mortgage interest statement, it's crucial to avoid errors that could lead to complications. Here are some mistakes often made and how you can avoid them:

- Ignoring the form because it has incorrect information. Instead, contact the lender for a corrected form.

- Failing to claim the deduction because the amount seems too small – every bit can count.

- Mixing up interest figures with property tax or insurance payments – they are recorded separately.

One of the biggest mistakes is not using the information from this form at all. Never omit it when filing your taxes, especially if you've been paying a lot of mortgage interest throughout the year.

Final Thoughts on IRS Form 1098

If you're preparing to file a 1098 mortgage interest statement, remember these tips. This form could be the key to unlocking potential deductions and lowering your tax bill. As you work through your tax return, make sure you have Form 1098 on hand, understand the information it contains, and use it properly to your advantage.

Latest News