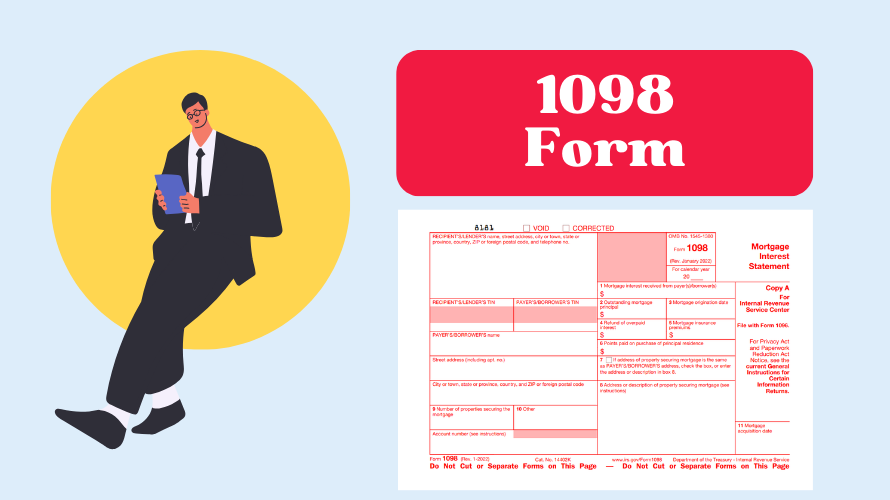

Printable 1098 Tax Form

When dealing with taxes, it's crucial to work with the right forms. If you're a person who deals with mortgage interest, you'll likely need to complete a printable federal tax form 1098. This form lets the IRS know how much interest you have paid during the year on your mortgage. To accurately complete this document, it's helpful to understand its structure.

Structure of the 1098 Tax Form for Print

A standard 1098 printable form includes several primary fields:

- The name and address of the payer (borrower)

- The name, address, and phone number of the recipient (lender)

- Account number

- Box 1, where the amount of mortgage interest received by the lender is reported

- Box 2, for reporting any outstanding mortgage principal

- Box 3, if applicable, for reporting points paid on the purchase of a principal residence

- Additional boxes to report items such as insurance premiums paid from escrow and property taxes paid

Guidelines for Filling Out Form 1098

To ensure that you complete the form accurately, follow this list of guidelines:

- Double-check the payer's identification number and the recipient's federal identification number, ensuring they are correct and legible.

- Report only the interest that was actually paid during the year, not interest that was accrued but unpaid.

- Include points if they are for the principal residence purchase and were paid directly to the lender.

- Do not include amounts for insurance, property taxes, or other costs unless specifically requested in the form.

Step-by-Step Guide to Filing Your 1098 Blank Form

After you have your 1098 printable form filled out, it's time to file it. Here is a straightforward guide to help you through the process.

- Review the completed form for any errors. Ensure all necessary fields are filled out, and the information is accurate.

- If you discover mistakes, make the necessary corrections on a new form to keep things clear and tidy.

- Attach Copy B of the completed Form 1098 to your tax return if you're mailing it in. Keep Copy C for your records.

- If you must file electronically, submit the information through an IRS-approved e-file provider or tax professional.

Deadline to File 1098 to the IRS

It's important to pay attention to the deadlines associated with tax forms to avoid any penalties. For the printable 1098 tax form for 2023, the form must be sent:

- to the borrower by January 31, 2024,

- filed with the IRS by February 28, 2024, if you're filing on paper,

- by March 31, 2024, if you're filing electronically.

Completing and filing a blank 1098 form printable doesn't have to be a daunting task. By understanding the form, following the guidelines, and proceeding step-by-step, you can accurately report your mortgage interest and file on time. Remember that these forms are essential for your yearly taxes, and accuracy is key. If you are ever uncertain, consult with a tax professional for guidance. They will ensure that your financial information is in good hands, leading to a smoother tax season.

Latest News